In the dynamic realm of stock market investing, savvy investors recognize that each industry has its unique patterns and cycles. Sector investing, a strategy that involves targeting specific industries, allows investors to capitalize on industry-specific stock trends. This article delves into the concept of sector investing, highlighting its benefits, strategies, and how to maximize returns by harnessing the power of sector rotation.

Understanding Sector Investing

Sector investing involves focusing on specific industries or sectors of the economy rather than individual companies. These sectors can range from technology and healthcare to energy and consumer goods. By targeting sectors with strong growth potential, investors can tap into emerging trends and capitalize on opportunities that align with their investment goals.

Benefits of Sector Investing

1. Diversification with Precision

Sector investing offers a unique way to diversify your portfolio. Instead of spreading your investments across various individual stocks, you can allocate funds to sectors that are poised for growth. This allows you to spread risk while maintaining exposure to specific trends driving each sector.

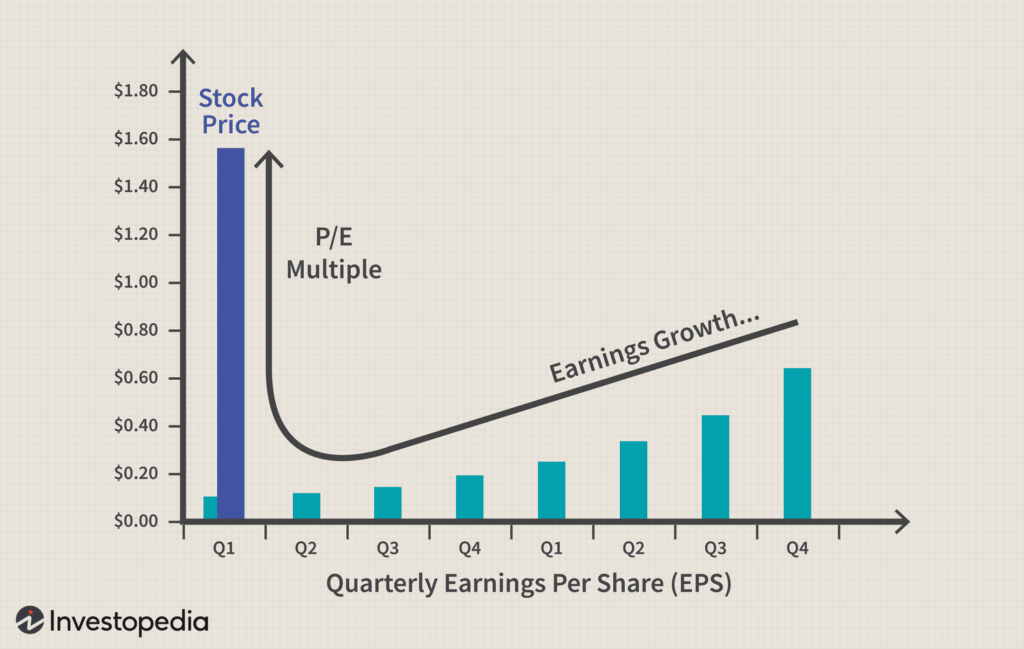

2. Capitalizing on Industry Cycles

Different sectors tend to perform well at different stages of the economic cycle. For example, during times of economic expansion, consumer discretionary and technology sectors may thrive, while during economic downturns, defensive sectors like utilities and healthcare may prove resilient. Sector investing allows you to position your portfolio to align with these cycles.

3. Targeting Your Interests and Expertise

Investing in sectors that align with your interests or expertise can provide a competitive advantage. If you have a strong understanding of a particular industry due to your professional background or personal passions, sector investing enables you to leverage that knowledge for potentially better investment decisions.

Strategies for Sector Investing

1. Trend Analysis

Conduct thorough research to identify sectors with strong growth potential. Analyze macroeconomic trends, technological advancements, and societal shifts that could drive demand for specific industries. By staying attuned to emerging trends, you can position yourself ahead of market shifts.

2. Sector Rotation

Sector rotation involves adjusting your portfolio allocation based on the prevailing stage of the economic cycle. During economic expansions, cyclical sectors may perform well, while defensive sectors may shine during downturns. Adapting your portfolio to align with these cycles can enhance returns and mitigate risk.

3. ETFs and Mutual Funds

Exchange-traded funds (ETFs) and mutual funds offer an accessible way to invest in specific sectors. These funds pool resources from multiple investors to invest in a diversified portfolio of stocks within a particular industry. Investing in sector-focused ETFs or mutual funds provides instant exposure to a specific sector’s performance.

Maximizing Returns with Sector Investing

1. Stay Informed

Continuously monitor industry news, regulatory changes, and technological advancements that could impact your chosen sectors. Staying informed ensures that you make well-informed decisions and adjust your portfolio as needed.

2. Maintain Balance

While sector investing offers diversification benefits, it’s important to maintain a balanced portfolio. Overemphasizing a single sector can expose your portfolio to sector-specific risks. Regularly review and rebalance your portfolio to ensure a diversified and well-structured allocation.

3. Long-Term Perspective

Sector investing should be approached with a long-term perspective. While short-term market fluctuations are inevitable, focusing on the underlying growth potential of your chosen sectors can lead to more successful outcomes over time.

Conclusion

Sector investing provides a strategic avenue for investors to profit from industry-specific stock trends. By diversifying your portfolio through targeted sector allocations, you can capitalize on emerging opportunities, navigate economic cycles, and leverage your knowledge and interests. Whether you opt for trend analysis, sector rotation, or investment funds, sector investing empowers you to optimize returns while managing risk. With careful research, informed decision-making, and a long-term mindset, sector investing can become a valuable tool in your investment arsenal.