The world of investing is often punctuated by significant milestones, and one such milestone that captures both excitement and uncertainty is an Initial Public Offering (IPO). An IPO marks a company’s transition from private to public ownership, enabling it to raise capital by offering shares to the general public. While IPOs present enticing opportunities for investors to become early stakeholders in promising companies, they also carry inherent risks. In this comprehensive guide, we will delve into the opportunities and risks associated with investing in IPOs.

The Opportunities of IPOs

Early Stake in Growth Companies

Investing in an IPO allows you to become an early shareholder in a potentially high-growth company. If the company performs well post-IPO, your shares could appreciate significantly.

Access to Innovation

Many IPOs belong to companies on the cutting edge of technology, innovation, and disruptive industries. Investing in these companies offers exposure to groundbreaking developments.

Potential for High Returns

The early stages of a company’s public journey can witness substantial price movements. If the market perceives the company favorably, its stock price could experience rapid growth.

Diversification

Including IPOs in your investment portfolio can diversify your holdings and expose you to a broader range of industries and sectors.

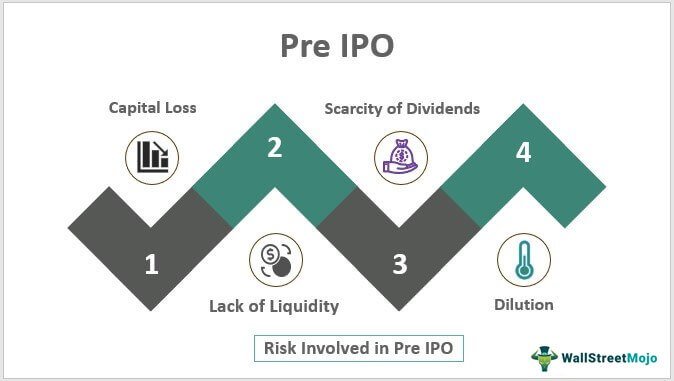

The Risks of IPOs

Market Volatility

IPOs are often accompanied by price volatility. Initial trading may lead to unpredictable price swings, exposing investors to potential losses.

Lack of Historical Data

IPOs may lack an extensive track record, making it challenging to assess their long-term performance and fundamentals.

Lock-Up Periods

Company insiders and early investors are often subject to lock-up periods during which they cannot sell their shares. Once the lock-up period expires, a sudden influx of shares into the market can affect stock prices.

Uncertain Valuation

Determining the appropriate valuation for an IPO can be complex. Overvaluation at the IPO stage can lead to disappointing returns.

Key Considerations for IPO Investing

Research Extensively

Thorough research is paramount. Study the company’s financials, business model, competitive landscape, and growth potential.

Understand the Prospectus

The prospectus provides essential information about the company’s financials, risks, and objectives. Analyze it carefully before making an investment decision.

Evaluate Underwriters

Underwriters play a crucial role in the IPO process. Assess their reputation, track record, and expertise.

Be Mindful of Timing

Consider the timing of your IPO investment. Participating in an IPO during a market downturn could expose you to additional risk.

Diversify Your Portfolio

While IPOs offer unique opportunities, ensure your portfolio remains diversified to mitigate risk.

Conclusion

Investing in IPOs is a nuanced endeavor that presents both tantalizing opportunities and potential pitfalls. As an investor, it’s essential to approach IPOs with a critical mindset, informed by thorough research, careful consideration, and a keen understanding of the associated risks.

By weighing the opportunities against the risks, conducting diligent research, and making well-informed decisions, you can position yourself to potentially capitalize on the early stages of promising companies and navigate the unpredictable waters of IPO investing. Remember, successful IPO investing requires a balanced approach that aligns with your overall investment strategy and risk tolerance.