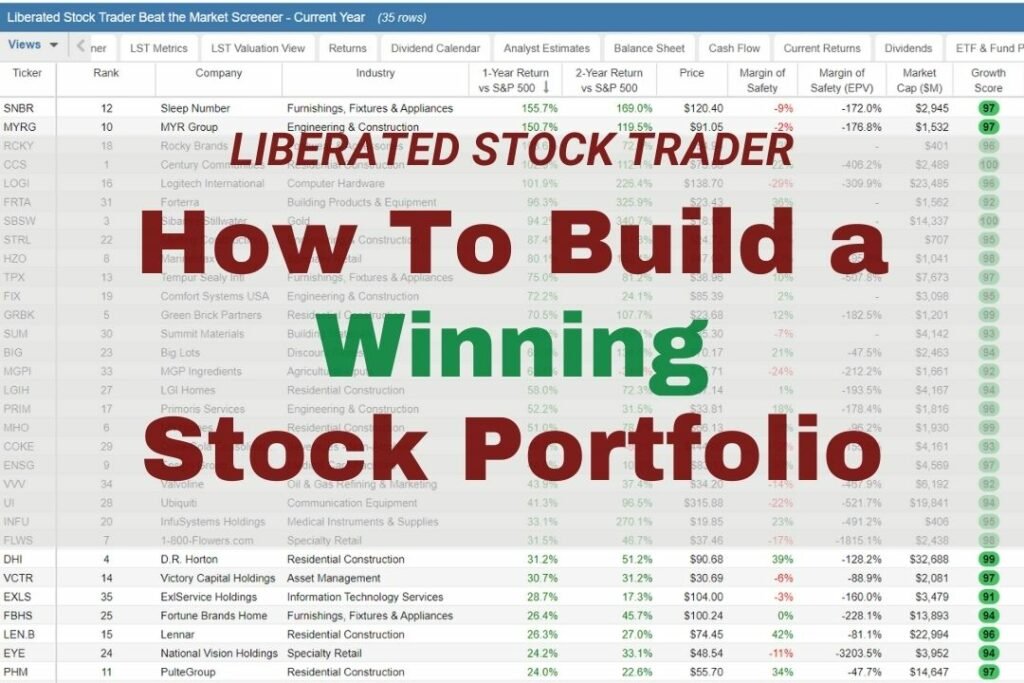

Building a winning stock portfolio is a strategic endeavor that requires careful planning, research, and a long-term perspective. Whether you’re a seasoned investor or just beginning your journey, crafting a portfolio that stands the test of time is essential for achieving financial success. In this comprehensive guide, we will delve into actionable tips and strategies that will set you on the path to long-term success in the stock market.

Define Your Investment Goals and Risk Tolerance

Before embarking on the journey of portfolio construction, it’s crucial to define your investment goals and assess your risk tolerance. Are you investing for retirement, wealth accumulation, or a specific financial milestone? Understanding your objectives will guide your asset allocation and investment decisions.

Diversification: The Bedrock of a Strong Portfolio

Diversification is the cornerstone of a resilient and winning portfolio. By spreading your investments across different asset classes, sectors, and regions, you reduce the impact of a single poor-performing investment on your overall portfolio.

- Asset Classes: Allocate your investments across stocks, bonds, real estate, and other assets to mitigate risk.

- Sectors and Industries: Invest in a variety of sectors to avoid overexposure to any one industry’s performance.

- Geographical Regions: Consider international investments to reduce country-specific risks.

Choose a Mix of Investment Styles

Incorporate a blend of investment styles, such as value, growth, and momentum, to capitalize on different market conditions and trends. This diversified approach can help you capture opportunities across various market cycles.

Conduct Thorough Research

Informed decisions stem from comprehensive research. Analyze company financials, industry trends, competitive landscape, and macroeconomic factors. Make sure you understand the companies you’re investing in and the potential risks and rewards.

Long-Term Perspective: The Power of Compounding

Compounding is the magic ingredient that fuels long-term success. By reinvesting dividends and allowing your investments to grow over time, you harness the exponential power of compounding, which can significantly amplify your returns.

Regularly Review and Rebalance

A winning portfolio requires ongoing attention. Regularly review your holdings and assess whether they align with your investment goals. Rebalance your portfolio periodically to ensure your asset allocation remains in line with your desired risk profile.

Stay Emotionally Resilient

Emotions can cloud judgment and lead to impulsive decisions. Stay focused on your long-term goals and avoid making knee-jerk reactions based on short-term market fluctuations. Emotional resilience is a key trait of successful investors.

Stay Informed and Adapt

The investment landscape evolves, and staying informed is vital. Keep up with market trends, economic developments, and technological advancements that could impact your investments. Adapt your portfolio as needed to stay ahead of the curve.

Seek Professional Advice

Consider consulting with a financial advisor who can provide personalized guidance based on your unique financial situation and goals. An experienced advisor can help you make informed decisions and navigate complex investment scenarios.

Conclusion

Crafting a winning stock portfolio is an art that combines strategy, knowledge, and discipline. By defining your goals, diversifying effectively, conducting thorough research, maintaining a long-term perspective, and staying emotionally resilient, you position yourself for long-term success in the dynamic world of stock market investing.

Remember, building a winning portfolio is not a one-time task; it’s an ongoing process that requires continuous learning, adaptability, and a commitment to your financial objectives. As you embark on this exciting journey, may these tips serve as your compass, guiding you towards a future of prosperity and financial well-being.